How to use Filters & Custom Formulas for Exit Orders

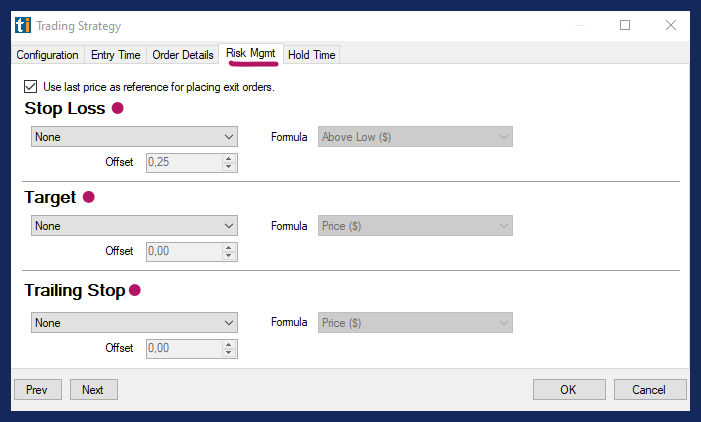

To use Trade Ideas Filters and Custom Formulas for Exit Orders, right-click in the Strategies Tab of Brokerage Plus and choose New/Edit Trading Strategy. Then, head to the Risk Management Section.

Risk Management Tab

Here, you’ll have the option to choose a Stop Loss or Trailing Stop and a Target.

Your options are to define your Stop and Target in Dollars, in Percent, or with the help of a Filter.

Trade Ideas does not hold any orders, all orders are immediately sent to the brokerage. For this reason, orders cannot be based on a value that requires constant monitoring and recalculation like a moving average or a bar stop.

Filter as Stop Loss

When using a Filter or Custom Formula as a Stop Loss, please note the following:

The calculation needs to result in a static Dollar/Percent Value

The filter value will be subtracted from the Price for Long Trades

Stop Loss = Price - Filter

The filter value will be added to the Price for Short Trades

Stop Loss = Price + Filter

Filter as Target

When using a Filter or Custom Formula as a Target, please note the following:

The calculation needs to result in a static Dollar/Percent Value

The filter value will be added to the Price for Long Trades:

Target = Price + Filter

The filter value will be subtracted from the Price for Short Trades:

Target = Price - Filter

Overview Use of Filters in Orders

As Entry Orders (Limit/Stop Limit)

| L/S | Order Type | Filter Reference | Filter Example | Filter Application | Result |

| Long | Stop Limit | Stop Formula | Today’s High $8 | Exact Filter Value in $ | Stop is placed at $8 |

| Long | Stop Limit | Limit Formula | Today’s High $8 | Price - Filter | If Price is $10 and Filter is $8 Limit = $2 |

| Short | Stop Limit | Stop Formula | Today’s Low $5 | Exact Filter Value in $ | Stop is placed at $5 |

| Short | Stop Limit | Limit Formula | Today’s Low $5 | Price + Filter | If Price is $10 and Filter is $8 Limit = $18 |

As Exit Orders (Stop Loss/Target/Trailing Stop)

| L/S | Order Type | Exit Type | Filter Example | Filter Application | Result |

| Long | Limit | Target | Today’s High $8 | Price + Filter | If Price is $6 and Filter is $8 Target = $14 |

| Long | Stop Market | Stop Loss | Today’s Low $4 | Price - Filter | If Price is $6 and Filter is $4 Stop Loss = $2 |

| Long | Stop Market | Trailing Stop | Today’s Low $6 | Price - Filter |

If Price is $10 and Filter is $6 Trailing Stop = $4 |

| Short | Limit | Target | Today’s Low $6 | Price - Filter | If Price is $10 and Filter is $6 Target = $4 |

| Short | Stop Market | Stop Loss | Today’s High $12 | Price + Filter | If Price is $10 and Filter is $8 Stop Loss = $18 |

| Short | Stop Market | Trailing Stop | Today’s High $8 | Price + Filter | If Price is $10 and Filter is $8 Trailing Stop = $18 |